-

-

FeaturesคุณสมบัติPenyelesaianRecursosFiturCaracterísticas精选功能精選功能المزايا

-

Solutionsโซลูชั่นPenyelesaianSoluçõesSolusiSoluciones解决方案解決方案الحلول

-

IntegrationsการผสานรวมIntegrasiIntegraçõesIntegrationsIntegraciones集成平台整合دمج مع تطبيقات أخرى

-

Affiliate/Partnersพันธมิตร/พันธมิตรทรัพยากรAfiliasi/Rakan KongsiAfiliados/ParceirosAfiliasi/MitraAfiliados/Partners联盟/合作伙伴聯盟/夥伴شريك

-

ResourcesจองการสาธิตSumberRecursosSumber dayaRecursosالموارد

WhatsApp Pay: How to Send and Receive Money?

Are you using WhatsApp often and want to learn how to use the new WhatsApp Pay feature? You’re in the right place! This guide will explain everything you need to know about WhatsApp Pay, like what it can do, why it’s useful, and how to use it effectively.

WhatsApp Pay is a big deal in digital payment, with a whopping 2.2 billion users in 100 countries. This means businesses can use it to make payments smoother for their customers and improve their overall experience.

WhatsApp Pay: Introduction and Brief Overview

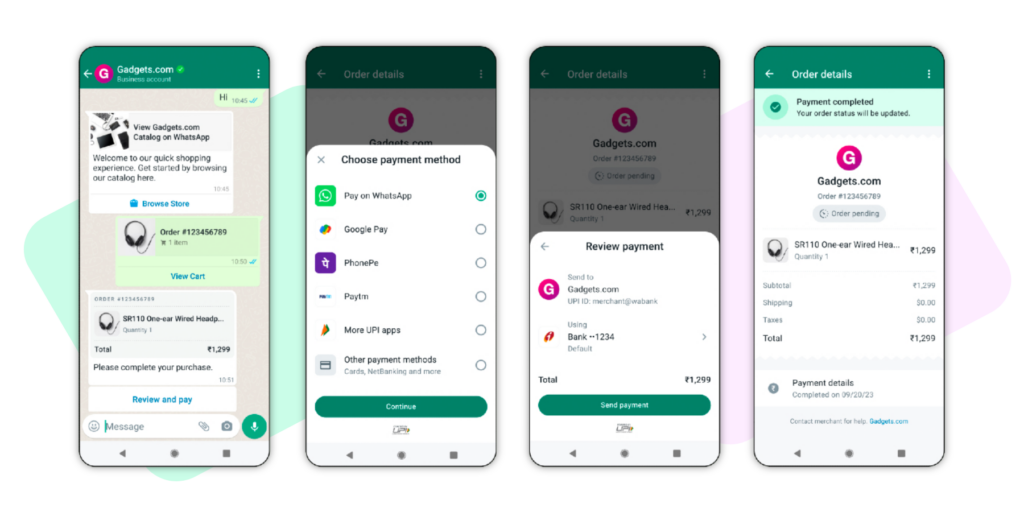

WhatsApp Pay is an extension of the popular messaging app, and it allows businesses to accept payments directly through the platform. This means you can receive payments from your customers without them having to leave the app, making the process seamless and convenient.

Let’s say a customer wants to make a payment through WhatsApp. You, as a business owner, can initiate the process by generating a payment request or sending a link directly within the chat.

Here’s where it gets convenient: the customer can follow the straightforward instructions, choose their preferred payment method, and complete the entire transaction without exiting the chat interface.

This level of simplicity and convenience is a game-changer for businesses. It reduces the friction in the payment process, making it hassle-free for customers and saving them valuable time. Moreover, the seamless integration of WhatsApp Pay within the messaging app ensures that communication flows smoothly between businesses and customers, facilitating efficient and hassle-free transactional interactions.

Also Check:

Features of Click to WhatsApp Ads

Setting up WhatsApp Shop AKA Catalog

Features and Integrations

Seamless Payment Experience

WhatsApp Pay allows businesses to provide customers with a frictionless payment experience. Customers can make payments directly within the chat, eliminating the need to switch to another app or platform. This simplicity enhances customer satisfaction and encourages repeat business.

Payment Links and Requests

Businesses can easily create and send payment links or payment requests to customers. This feature simplifies the payment process, making it convenient for both parties. Customers can click on the link and complete the payment with ease.

Multiple Payment Methods

WhatsApp Pay supports various payment methods, including credit and debit cards, UPI (Unified Payments Interface), and other digital wallets. This flexibility enables businesses to cater to a wider range of customers and their preferred payment options.

Secure Transactions

Security is a top priority. WhatsApp Pay incorporates robust security measures to protect both businesses and customers. End-to-end encryption ensures that payment information remains confidential and secure.

Customer Communication

WhatsApp Pay seamlessly integrates with the messaging capabilities of the popular app. Businesses can communicate with customers before, during, and after transactions. This real-time communication can enhance customer support and address any payment-related queries promptly.

API Integration

WhatsApp Pay can be accessed for larger businesses and enterprises through API integration. This allows for customised solutions and greater control beyond payment processes.

Global Reach

With WhatsApp’s extensive user base spanning over 100 countries, businesses can reach a diverse and global audience. This is especially advantageous for businesses looking to expand their international presence.

Benefits and Solutions

Customer Trust: Leveraging a widely used and trusted platform like WhatsApp can enhance customer trust and confidence in your business, leading to increased loyalty and repeat business.

Streamlined Transactions: Payment links and requests make it easy for businesses to initiate and complete transactions. This feature is particularly valuable for e-commerce businesses, service providers, and freelancers looking for an efficient way to collect payments.

Saves Time & Effort: By integrating payment services within the app, customers no longer need to switch between different platforms or apps to complete a transaction. This streamlines the payment process, making it quicker and more efficient.

Furthermore, WhatsApp offers a user-friendly interface that is intuitive and easy to navigate. The app provides clear instructions and prompts, ensuring that even first-time users can easily set up and use the payment service. The straightforward design and user-friendly interface make WhatsApp Pay accessible to many users, regardless of their technological expertise.

WhatsApp Pay: How It Brings Revolution in Mobile Payment Services

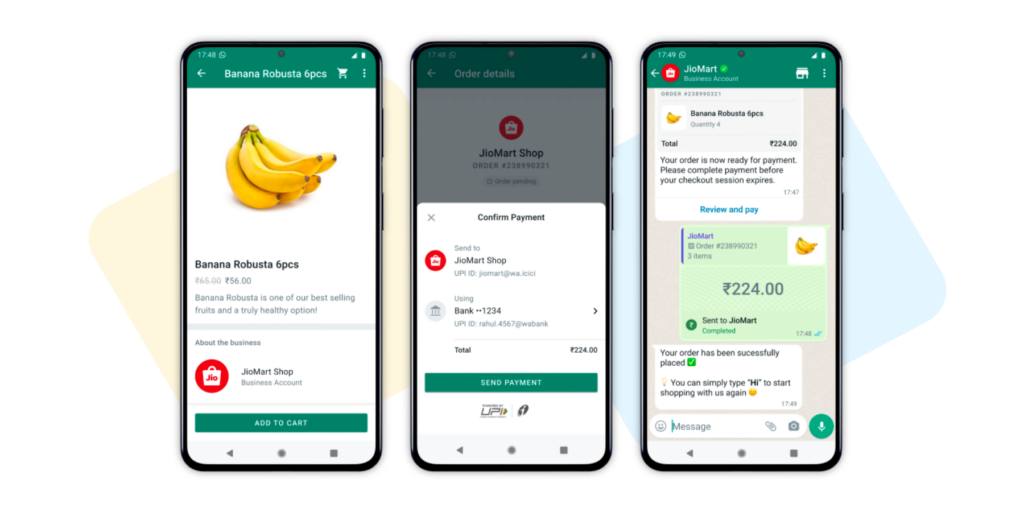

WhatsApp Pay is reshaping the landscape of mobile payment services with its massive user base of over 500 million in India, making it Meta’s largest global market. This revolutionary platform, built upon UPI, initially launched in India as a pilot in 2020, swiftly expanding to serve 100 million users within a year.

Previously, Indian businesses on WhatsApp could accept payments through UPI-based WhatsApp Pay, with conglomerates like Reliance Industries offering comprehensive shopping experiences via WhatsApp’s JioMart bot.

The latest update takes things up a notch, introducing third-party payment options for merchants on the platform, further streamlining the customer experience and expanding WhatsApp’s potential as a commerce solution.

In a recent announcement on September 20, 2023, the Meta-owned app revealed strategic partnerships with PayU and Razorpay, enabling payments through credit and debit cards, net banking, and all UPI apps in India.

This move follows WhatsApp’s successful partnership with Stripe earlier in the year, facilitating user payments to businesses in Singapore through the app. WhatsApp Pay has also made strides in Brazil, enabling seamless merchant payments since June.

This payment method is at the forefront of mobile payment services, enhancing convenience, expanding payment options, and empowering users and businesses across the globe.

WhatsApp Payment: How the Transaction Process Works

To use WhatsApp Pay, you and your customers should have a WhatsApp account linked to your mobile phone numbers. Here’s how WhatsApp Pay operates for you:

#1 As a business using WhatsApp Pay, you can initiate a payment request or share a payment link with your customers via chat.

#2 Your customers, on the other hand, will receive this payment request or link right in your WhatsApp chat.

#3 Your customers can choose their preferred payment method, whether it’s bank transfers, credit or debit cards, or mobile wallets.

#4 After making their choice, your customers will follow the instructions provided by WhatsApp Pay to complete the payment. This entire process is secure and takes place within the WhatsApp platform.

#5 Once the payment is successfully processed, you will receive a notification, and all the transaction details will be automatically stored in your chat conversation for your reference.

Security and Data Handling

All transactions made through WhatsApp Pay are encrypted end-to-end, ensuring that your financial information remains secure and inaccessible to unauthorised individuals.

Additionally, WhatsApp Pay adheres to the strict guidelines of the Reserve Bank of India (RBI). This ensures the service maintains high security and compliance standards, providing users with a trustworthy and reliable platform for their financial transactions.

WhatsApp Pay also employs multi-factor authentication, requiring users to verify their transactions with a UPI PIN or biometric authentication. This makes it more secure, preventing unauthorised access to your funds and ensuring that only you can initiate and authorise transactions.

WhatsApp Pay follows stringent privacy policies regarding data handling and safeguards user data. The service does not store or share your financial information with third parties, further enhancing the security and privacy of your transactions.

WhatsApp Pay: Step-by-Step Guide for Sending Money

Sending money through WhatsApp Pay is a simple process. Follow these step-by-step instructions to send money to your contacts:

1. Open a chat with the recipient to whom you want to send money.

2. Tap on the attachment icon (paperclip icon) next to the text input field.

3. From the options that appear, select “Payment.”

4. Enter the desired amount you wish to send.

5. Add an optional note if necessary.

6. Verify the transaction using your UPI PIN or biometric authentication.

7. Once verified, the funds will be deducted from your linked bank account and instantly transferred to the recipient’s account.

8. You will receive a confirmation message indicating the successful transaction.

It’s important to ensure you have linked your bank account to WhatsApp Pay before initiating any transactions. This can be done by following the instructions provided within the app.

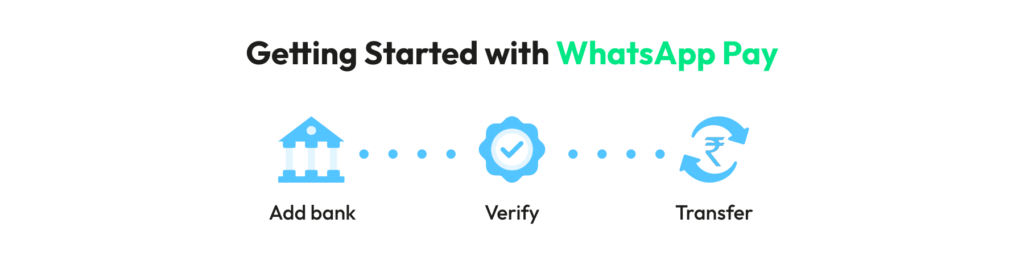

How to Enable WhatsApp Payment

Enabling WhatsApp Payment is a simple process that requires a few steps to set up. Here’s how you can enable WhatsApp Payment on your device:

1. Open WhatsApp on your smartphone.

2. Go to “Settings” by clicking the three dots in the top-right corner.

3. Select “Payments” from the list of options.

4. Tap on “Add Payment Method.”

5. Choose your bank from the available options.

6. Follow the instructions to link your bank account to WhatsApp Pay.

7. Once linked, you can send and receive money through WhatsApp Pay.

Notably, WhatsApp Pay is available only for users in select countries. Ensure that your country is supported before enabling and using the service.

How to Manage Multiple Bank Accounts with WhatsApp Payment

You’re in luck if you have multiple bank accounts! WhatsApp Pay allows you to link and manage multiple bank accounts, providing flexibility and convenience. Here’s how you can manage multiple bank accounts with WhatsApp Pay:

1. Open WhatsApp on your smartphone.

2. Go to “Settings” by tapping the three dots in the top-right corner.

3. Select “Payments” from the list of options.

4. Tap on “Add New Account.”

5. Choose the bank you want to link from the list of available options.

6. Follow the on-screen instructions to link the new bank account.

7. Once linked, you can switch between different bank accounts within the WhatsApp Pay interface.

This feature is handy if you have separate accounts for personal and business transactions or if you share finances with a partner or family member. By managing multiple bank accounts within WhatsApp Pay, you can easily keep track of transactions and organise your finances effectively.

Transaction Fees and Offers

WhatsApp Pay does not charge transaction fees for sending or receiving money. This makes it an attractive choice for users who want to save on transaction costs and avoid additional charges.

However, it’s important to note that your bank may levy certain charges for using UPI-based payment services. These charges can differ depending on your bank and the type of transaction. It is advisable to check with your bank for any applicable fees or charges before using WhatsApp Pay.

In addition to the absence of transaction fees, WhatsApp Pay offers various promotional offers and cashback schemes occasionally. These offers can provide additional savings and incentives for using the service. Watch for such offers within the app and take advantage of them to maximise your benefits.

WhatsApp Pay: Pros and Cons

Like any other payment service, WhatsApp Pay has pros and cons. Let’s look at some advantages and disadvantages.

Pros:

– Seamless integration with WhatsApp, making transactions quick and convenient.

– User-friendly interface.

– Enhanced security measures, including end-to-end encryption and multi-factor authentication.

– Ability to link and manage multiple bank accounts within the app.

– No transaction fees for sending or receiving money.

Cons:

– Limited availability in select countries.

– Reliance on stable internet connectivity for smooth transactions.

– Potential compatibility issues with older smartphone models.

– Dependency on UPI-based payment systems, which may have their limitations.

Despite the limitations, WhatsApp Pay offers millions of users a compelling and convenient payment solution.

What are the steps if someone encounters issues with WhatsApp Pay?

Check for App and System Updates

Ensure that your WhatsApp and device operating system (iOS or Android) are up to date. Outdated apps or software can sometimes cause compatibility issues.

Check Network Connection

Make sure that you have a stable internet connection. Any payment app would require an active internet connection to function properly. Switch between Wi-Fi and mobile data to see if the issue persists.

Verify WhatsApp Version

Make sure you are using an official version of WhatsApp downloaded from your device’s app store (Play Store for Android or App Store for iOS). Unofficial or modded versions may not support WhatsApp Pay.

Update Payment Information

Ensure that your payment information, such as your linked bank account or credit card, is accurate and updated in your app settings.

Check Transaction Limits

There could be transaction limits set by the National Payments Corporation of India (NPCI). Ensure that your transaction falls within these limits. For example, there may be daily or per-transaction limits.

Clear Cache and Data

In the device settings, you can clear the cache and data for the WhatsApp app. This can resolve issues related to temporary data or glitches. Remember to back up your chats before doing this, as it will log you out of WhatsApp.

Restart Your Device

Sometimes, a simple device restart can resolve technical issues. Try turning off your phone, waiting a few seconds, and then turning it back on.

Contact Customer Support

If the issue persists and you believe it’s related to a specific transaction or account problem, reach out to WhatsApp customer support.

Beware of Scams

Be cautious about sharing personal or financial information with anyone claiming to be from WhatsApp support. WhatsApp does not ask for sensitive information like bank account numbers or PINs through the app.

Consider Alternative Payment Methods

If you can’t resolve the issues, consider using alternative payment methods, such as other digital wallets or online banking platforms, to complete your transactions.

Remember that WhatsApp Pay may have specific features and functionality that can vary by region, and it’s important to use it in compliance with your local regulations and policies. If the issue remains unresolved after attempting these steps, contacting WhatsApp customer support or your bank for assistance may be necessary to diagnose and fix the problem.

Conclusion: WhatsApp Pay Unlocks Exciting Opportunities

In this blog, you’ve learnt about WhatsApp Pay and how it’s changing how we handle digital payments. The payment app is not just for individuals; businesses can also use it through Wati.

If you want to try out WhatsApp Pay for your business through our beta program, please get in touch with us. We’ll assess certain conditions related to your business to see if they fit the criteria for the beta program.

Together, we can harness the power of this new payment to revolutionize your business services. Don’t miss out on this chance to stay at the forefront of mobile payments. Reach out to us today!

Frequently Asked Questions

1. What is WhatsApp Pay?

WhatsApp Pay is a feature within the popular messaging app that allows you to send & receive money to and from their contacts. It enables seamless peer-to-peer (P2P) transactions, making it easy to pay friends and family directly through the app.

2. How do I set up WhatsApp Pay?

- Open WhatsApp and go to the chat with the contact you want to send money to.

- Tap the attachment icon and select “Payment.”

- Add a payment method (debit card, credit card, or linked bank account) and set a UPI (Unified Payments Interface) PIN.

- Once set up, you can send and receive money by selecting the payment option in your chat.

3. Is WhatsApp Pay secure?

Yes, the payment app prioritises security and uses end-to-end encryption to protect payment transactions. Your financial information is secured, and transactions require a UPI PIN for verification.

4. Which countries support WhatsApp Pay?

WhatsApp Pay is available in multiple countries, including India, Brazil, and others. The availability may vary by region, and WhatsApp continues to expand its services to additional countries.

5. Can I send money internationally with WhatsApp Pay?

No, WhatsApp Pay is currently designed for domestic money transfers within the country where it’s available. International money transfers are not supported at the moment.

6. Are there any fees for using WhatsApp Pay?

As of now, There are no fees for sending or receiving money. However, your bank may impose transaction fees, so it’s advisable to check with your bank for any applicable charges.

7. Can I pay bills and make purchases with WhatsApp Pay?

Yes, you can pay bills and purchase from select merchants and businesses supporting the service. You can also use it for various financial transactions, including mobile recharges and utility bill payments.

8. How do I send money using WhatsApp Pay?

To send money:

- Open a chat with the contact you want to send money to.

- Tap the attachment icon and select “Payment.”

- Enter the amount and a brief description of the transaction.

- Verify the details and enter your UPI PIN to complete the payment.

9. How do I receive money with WhatsApp Pay?

To receive money:

- The sender initiates the payment by selecting your contact in their chat.

- You will receive a payment notification.

- Tap the notification and follow the instructions to accept the payment, or it may be automatically deposited into your linked bank account.

Please note that WhatsApp Pay features and availability may change over time, and it’s important to refer to the latest information and updates from WhatsApp and your financial institution for the most accurate details.

Latest Comments