WhatsApp Pay: How to Send and Receive Money?

Written by:

Shreya

|

on:

October 13, 2023

|

Last updated on:

November 28, 2025

|

Fact Checked by :

Shreya

|

on:

October 13, 2023

|

Last updated on:

November 28, 2025

|

Fact Checked by :

Namitha

|

According to: Editorial Policies

Namitha

|

According to: Editorial Policies

Too Long? Read This First

- It's No Longer Optional: With over 2 Billion users worldwide for 2025, WhatsApp is where your customers are. They now expect to message businesses directly.

- Unmatched Engagement: WhatsApp campaigns destroy traditional channels with an average 98% open rate, compared to just 20% for email.

- Drives Real ROI: Conversational marketing on WhatsApp isn't just about chats; it's about revenue. Businesses see higher conversions (up to 45-60% CTR) in their GTM campaigns

- The API is Key: The free WhatsApp Business App is for small shops. Serious marketing, like broadcasts, automation, and analytics, requires the WhatsApp Business API and a platform like Wati to manage it.

- Compliance is Crucial: You cannot spam. Effective WhatsApp marketing relies on getting explicit opt-in (consent) from your customers before sending any messages.

Payments are the final steps in the customer journey; if you struggle with a clunky third-party payment method, there is a higher possibility that you will lose the sale because of the checkout flows.

This is where WhatsApp Pay steps in as a native payment method. WhatsApp Pay is a built-in payment option inside WhatsApp that provides a frictionless payment experience for users.

In this article, we’ll learn more about WhatsApp Pay, how to activate WhatsApp payment, and how to generate WhatsApp payment links in 2025.

Whatsapp Pay: A Brief Introduction

WhatsApp Pay is an extension of the popular messaging app, and it allows businesses to accept payments directly through the platform.

This means you can receive payments from your customers without them having to leave the app, making the process seamless and convenient.

As of 2024, National Payments Corporation of India (NPCI), has lifted the cap on the earlier 100 million UPI users that WhatsApp Pay can onboard. Now, WhatsApp Pay can onboard between 100-500 million users.

With over 2.2 billion users in 100 countries, WhatsApp is the best channel for direct B2C sales.

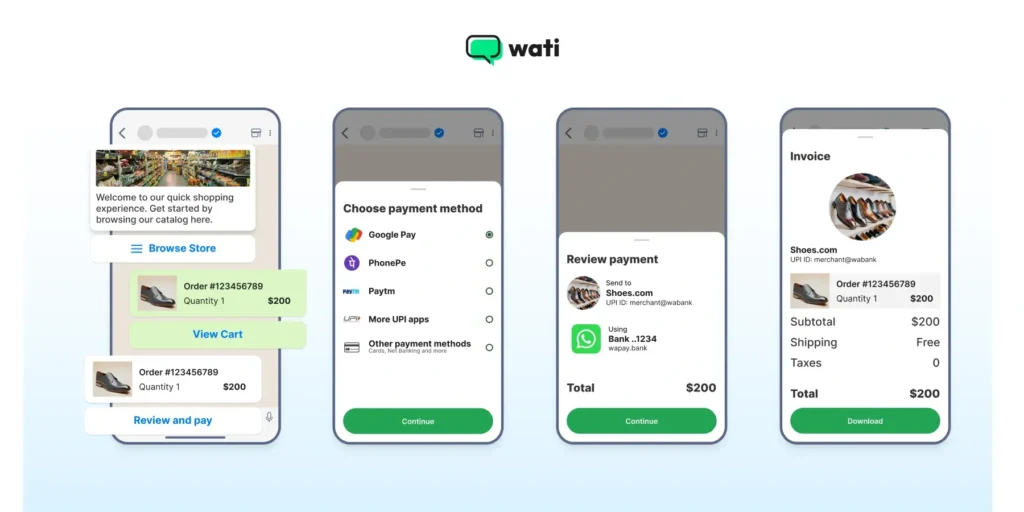

Example of WhatsApp Payments for Direct Sales

Let’s say a customer wants to make a payment through WhatsApp. You, as a business owner, can initiate the process by generating a payment request or sending a WhatsApp Pay link directly within the chat.

Enabling WhatsApp Pay as an option in your automated payment workflow assures the customer that they are important to the brand. It gives you the status of a consumer-first, inclusive brand that takes extra pains for customer convenience.

You made it easy for the customer can follow the straightforward instructions, choose their preferred payment method, and complete the entire transaction without exiting the chat interface.

This level of simplicity and convenience is a game-changer for businesses. It reduces the friction in the payment process, making it hassle-free for customers and saving them valuable time.

Moreover, the seamless integration of WhatsApp Pay within the messaging app ensures that communication flows smoothly between businesses and customers, facilitating efficient and hassle-free transactional interactions.

How to Activate Whatsapp Pay: Step-By-Step Guide for Sending Money in India

If you prefer WhatsApp Pay for fund transfer, you need to be registered UPI users and have a valid phone number as well as a UPI ID.

WhatsApp Pay, built on India’s UPI service, lets you send and receive money as easily as you send a message. It’s fast, secure, and all happens right inside your chat window.

Here is everything you need to know, from your very first setup to your 100th transaction:

Pre-Setup Checklist Before You Start

Before you send your first rupee, ensure the following non-negotiables.

- You need to have the latest version of WhatsApp installed.

- You need an active bank account in India that supports UPI.

- Your WhatsApp phone number must be the exact same number that is registered with your bank account.

- You’ll need your bank’s debit card (for the last 6 digits and the expiry date) to create your secure UPI Pin.

How to Link Your Bank Account to Whatsapp Pay (Step by Step)

Follow these steps to link your bank account with your WhatsApp account to set up payment gateway:

- Open WhatsApp and tap the three-dot menu (on Android) or Settings tab (on iPhone).

- Select “Payments” from the menu.

- Tap on “Add payment method” and accept the payment terms.

- WhatsApp will show a list of banks. Select your bank.

- WhatsApp will then need to verify your phone number. Tap “Verify via SMS” (standard SMS charges may apply). It will automatically send an SMS from your phone to verify.

- Once verified, WhatsApp will find the bank account(s) linked to your number. Select the account you want to use for payments.

- Tap “Done” to finish.

- Set your UPI PIN. If this is your first time using a bank account with UPI, you’ll be prompted to create a 4 or 6-digit PIN. You will need your debit card details for this.

- If you already have a UPI PIN for this account (from another app, such as Google Pay or PhonePe), you can simply enter it.

- Once linked, you can send and receive money through WhatsApp Pay.

Security tip: Never share your UPI PIN with anyone. It is private and confidential data, just like your ATM PIN. No one from WhatsApp, your bank, or any other service will ever call you or message you for it.

How to Send Money via WhatsApp Pay (The Easy Part)

Once you have figured out all the preset checklists and bank details, sending money is probably the easiest step to follow.

- Open the WhatsApp Chat with a person you want to send money to.

- Tap on the “attachment icon” (the paperclip on Android and the plus sign on iPhone) next to the message box.

- From the options, select “Payment” (it has a rupee symbol).

- Enter the desired amount you wish to send. You can also add an optional note (e.g For Lunch).

- Tap the “Send” or “Next” Button.

- You will be prompted to enter your secret UPI Pin to authorize the transaction.

- Once you enter the PIN, the money is transferred. You will see a confirmation message right in the chat with the transaction details (like a little receipt) . It will show as “successful”, “Processing”, or “Pending”.

You can also send money by scanning the QR code or entering a UPI ID directly from the “Payments” setting screen.

Notably, WhatsApp Pay is available only for users in select countries. Ensure that your country is supported before enabling and using the service.

Which Countries Support WhatsApp Pay?

Launched in February 2020, WhatsApp Pay was first introduced in India. Apart from India, there are a couple of other countries that use WhatsApp Pay.

The availability and features vary by country. Below are the three countries that accept WhatsApp Pay.

- India: WhatsApp Pay is used to support e-commerce business transactions, powered by the UPI service.

- Brazil: Supports peer to peer and business transactions, using Meta Pay (Formerly Facebook Pay) in partnership with local finance providers. You can pay registered businesses directly via WhatsApp chat.

- Singapore: Supports WhatsApp Payments through a partnership between Meta Pay and Stripe. In Singapore, you can also pay off local businesses directly via credit or debit cards or Pay Now in the WhatsApp chat itself.

WhatsApp Payment: How the Transaction Process Works for Businesses

To use WhatsApp Pay, you and your customers should have a WhatsApp account linked to your mobile phone numbers. Here’s how WhatsApp Pay operates for you:

- WhatsApp Pay Link: As a business using WhatsApp Pay, you can initiate a payment request or share a WhatsApp pay link with your customers via chat.

- Customer confirmation: Your customers, on the other hand, will receive this payment request or link right in your WhatsApp chat.

- Payment method: Your customers can choose their preferred payment method, whether it’s bank transfers, credit or debit cards, or mobile wallets.

- Instructions: After making their choice, your customers will follow the instructions provided by WhatsApp Pay to complete the payment. This entire process is secure and takes place within the WhatsApp platform.

- Payment confirmation: Once the payment is successfully processed, you will receive a notification, and all the transaction details will be automatically stored in your chat conversation for your reference.

How to Manage Multiple Bank Accounts With WhatsApp Payments

In case you have multiple bank accounts. WhatsApp Pay allows you to link and manage multiple bank accounts, providing flexibility and convenience.

Here is how you can manage multiple bank accounts with WhatsApp Pay.

1. Open WhatsApp on your smartphone.

2. Go to “Settings” by tapping the three dots in the top-right corner.

3. Select “Payments” from the list of options.

4. Tap on “Add New Account.”

5. Choose the bank you want to link from the list of available options.

6. Follow the on-screen instructions to link the new bank account.

7. Once linked, you can switch between different bank accounts within the WhatsApp Pay interface.

This feature is handy if you have separate accounts for personal and business transactions or if you share finances with a partner or family member.

By managing multiple bank accounts within WhatsApp Pay, you can easily keep track of transactions and organise your finances effectively.

Top Benefits of WhatsApp Pay in Handling Customer Transactions

By integrating WhatsApp Pay as a part of your WhatsApp broadcast strategy, you are not letting the consumer go off the WhatsApp platform.

Rather, with integrated payments, you’ve unified an end-to-end experience as a brand. Below are the top benefits of WhatsApp Pay in handling consumer transactions.

Seamless Payment Experience

WhatsApp Pay allows businesses to provide customers with a frictionless payment experience. Customers can make payments directly within the chat, eliminating the need to switch to another app or platform.

This simplicity enhances customer satisfaction and encourages repeat business.

Payment Links and Requests

Businesses can easily create and send payment links or payment requests to customers. This feature simplifies the payment process, making it convenient for both parties.

Customers can click on the link and complete the payment with ease.

Seamless Payment Methods

WhatsApp Pay supports different payment methods depending on the country. In India, It is powered by UPI or peer-to-peer payments.

In Brazil, payments are processed through Mastercard and Visa debit/prepaid cards.

In Singapore, WhatsApp payments run via Stripe, supporting credit/debit cards and Pay Now.

This flexibility enables businesses to cater to a wider range of customers and their preferred payment options.

Customer Communication

WhatsApp Pay seamlessly integrates with the messaging capabilities of the popular app. Businesses can communicate with customers before, during, and after transactions.

This real-time communication can enhance customer support and address any payment-related queries promptly.

API Integration

While WhatsApp Pay isn’t available for business transactions, larger enterprises can integrate third-party payment gateways into WhatsApp using Business API tools like Wati.

These tools can send payment links, trigger checkout workflows, and automate payment confirmations, allowing brands to manage transactions seamlessly within the chat experience , even though the actual payment happens outside WhatsApp.

This allows for customised solutions and greater control beyond payment processes.

Security

All transactions made through WhatsApp Pay are bound by strict WhatsApp security guidelines and end-to-end encryption.

In India, Reserve Bank of India (RBI) monitors the NPCI-UPI framework powering WhatsApp Pay, it’s hard to break that security. This ensures high security and compliance standards, providing users with a trustworthy and reliable platform for financial transactions.

Whereas in Brazil and Singapore, WhatsApp Pay is allowed via Meta Pay, which is governed by local financial policies and rules.

WhatsApp Pay also employs multi-factor authentication, requiring users to verify their transactions with a UPI PIN or biometric authentication.

WhatsApp Pay Links

WhatsApp Pay Links are a trusted and reliable method of money disbursement. Payment links and requests make it easy for businesses to initiate and complete transactions.

This feature is particularly available for e-commerce businesses, service providers, and freelancers looking for an efficient way to collect payments.

Save Time and Effort

By integrating payment services within the app, customers no longer need to switch between different platforms or apps to complete a transaction. This streamlines the payment process, making it quicker and more efficient.

Furthermore, WhatsApp offers a user-friendly interface that is intuitive and easy to navigate. The app provides clear instructions and prompts, ensuring that even first-time users can easily set up and use the payment service.

The straightforward design and user-friendly interface make WhatsApp Pay accessible to a wide range of users, regardless of their technological expertise.

Streamlined Transactions

Payment links and requests make it easy for businesses to initiate and complete transactions. This feature is particularly valuable for e-commerce businesses, service providers, and freelancers looking for an efficient way to collect payments.

Does WhatsApp Pay Charge Any Transaction Fees?

WhatsApp Pay (UPI) itself does not charge any fees for peer-to-peer payments on the consumer app.

However, businesses using WhatsApp Business API to send payment links through partners like Wati or other BSPs incur regular e-commerce processing charges from their chosen payment gateway (typically 1.75 – 2.5 % + GST).

Meta classifies messages containing payment links or order confirmations as Utility templates, which are billed per message under the WhatsApp Business Platform pricing model.

Therefore, your total transaction cost equals the payment gateway’s fee + the cost of the WhatsApp API message used to complete the purchase.

What to Do if WhatsApp Pay Isn’t Working?

Proper working on WhatsApp Pay depends on a lot of attributes; WhatsApp Business API like Wati’s subscription, Meta server outage, account balance, network operator glitches, and so on.

Below are the steps you can take if you encounter issues with WhatsApp Pay:

Check for App and System Updates

Check if your WhatsApp and device operating system (iOS or Android) are up to date. Outdated apps or software can sometimes cause compatibility issues.

Check Network Connection

Make sure that you have a stable internet connection. Any payment app would require an active internet connection to function properly. Switch between Wi-Fi and mobile data to see if the issue persists.

Verify WhatsApp Version

Make sure you are using an official version of WhatsApp downloaded from your device’s app store (Play Store for Android or App Store for iOS). Unofficial or modded versions may not support WhatsApp Pay.

Update Payment Information

Make sure your payment information, such as your linked bank account or credit card, is accurate and updated in your app settings.

Check Transaction Limits

There could be transaction limits set by respective payment authorities. Make a point your transaction falls within these limits. For example, there may be daily or per-transaction limits.

Clear Cache and Data

In the device settings, you can clear the cache and data for the WhatsApp app. This can resolve issues related to temporary data or glitches. Remember to back up your chats before doing this, as it will log you out of WhatsApp.

Restart Your Device

Sometimes, a simple device restart can resolve technical issues. Try turning off your phone, waiting a few seconds, and then turning it back on.

Contact Customer Support

If the issue persists and you believe it’s related to a specific transaction or account problem, reach out to WhatsApp customer support.

Beware of Scams

Be cautious about sharing personal or financial information with anyone claiming to be from WhatsApp support. WhatsApp does not ask for sensitive information like bank account numbers or PINs through the app.

Consider Alternative Payment Methods

If you are unable to resolve the issues, consider using an alternative payment method, such as a digital wallet or online banking platform, to complete your transactions.

Furthermore, WhatsApp offers a user-friendly interface that is intuitive and easy to navigate. The app provides clear instructions and prompts, ensuring that even first-time users can easily set up and use the payment service. The straightforward design and user-friendly interface make WhatsApp Pay accessible to many users, regardless of their technological expertise.

Note: Remember that WhatsApp Pay may have specific features and functionality that can vary by region, and it’s important to use it in compliance with your local regulations and policies. If the issue remains unresolved after attempting these steps, contacting WhatsApp customer support or your bank for assistance may be necessary to diagnose and fix the problem.

Fuel Ui-Friendly Payment Experiences With Whatsapp Pay

With WhatsApp Pay, you can build greater brand loyalty, send payment links, and empower seamless purchases to give a memorable experience for your customers.

As WhatsApp marketing grows in prominence, investing in a full-fledged customer infrastructure with WhatsApp Business API, like Wati, automates efforts and offers more ways of payment convenience for customers.

Please note that WhatsApp Pay features and availability may change over time, and it’s important to refer to the latest information and updates from WhatsApp and your financial institution for the most accurate details.

Unify all experiences, from lead generation to chatbot service, purchase, and order delivery for your e-commerce brand with Wati. Book a free demo to know what’s more in store.

To accept payments on the Business API, you need two key components: 1) A supported payment gateway (like Razorpay, Stripe, PayU, etc.) and 2) A WhatsApp Business API provider, like Wati. The API provider gives you the platform and automation tools to connect your gateway to your WhatsApp chat flow.

Meta (WhatsApp) does not charge a direct “payment transaction fee.”The processing fee charged by your payment gateway (e.g., 3% + GST). The standard Meta API message fee (billed as a “Utility” template) for sending the payment link and order confirmation.

Yes. This is a primary benefit of the API. Using a no-code chatbot builder, you can create automation flows. For example, when a customer types “I want to buy” or adds an item to their cart, the bot can automatically generate and send the unique payment link, guiding them to checkout.

Yes, completely. The consumer feature you use with friends is for free, peer-to-peer (P2P) bank transfers. The business solution is for peer-to-business (P2B) commerce.