WhatsApp For Banking: Streamlining Financial Efficiency

Written by:

Rohan

|

on:

December 19, 2025

|

Last updated on:

February 16, 2026

|

Fact Checked by :

Rohan

|

on:

December 19, 2025

|

Last updated on:

February 16, 2026

|

Fact Checked by :

Namitha

|

According to: Editorial Policies

Namitha

|

According to: Editorial Policies

Too Long? Read This First

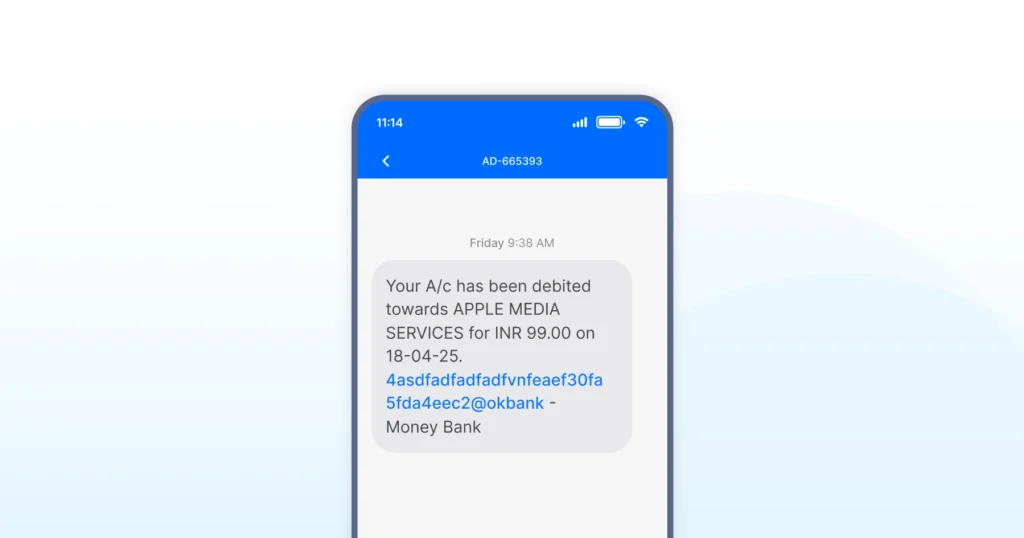

- SMS has supported banking for years, but its one-way communication, limited security, and lack of rich features make it less effective for today’s customers.

- The WhatsApp API for modern banking offers secure, conversational, and interactive experiences that help customers get clarity, complete tasks, and stay informed in real time.

- WhatsApp enables banks to automate key services like balance checks, transaction history, loan updates, onboarding steps, and everyday customer queries.

- Integrating WhatsApp API is straightforward with the right provider, especially when using tools like automation flows, shared inboxes, and SMS fallback for reliable message delivery.

- Banks choosing a platform like Wati gain stronger security, smoother workflows, and better scalability for high-volume communication.

- WhatsApp API creates a more engaging, efficient, and customer-friendly alternative to SMS for modern banking.

Only the banks that prioritise customer experience are believed to be the most trusted and reliable banks for financial investment.

Customers either have to pay for in-person visits to banks or use complex net banking services to make financial transactions or manage bank accounts.

With the increase in active user base of WhatsApp, now many banks across the world have switched to WhatsApp Business API tools.

Banks that offer financial services via the WhatsApp Business API tool offer features like bank balance access, sending and receiving money, mini statements, cheque services, loan approval confirmation, and more around the clock.

Banks avail WhatsApp API tools like Wati to also forward festival wishes, promotional offers, financial advice, and more. In this guide, we’ll learn how utilizing WhatsApp for banking and financial operations helps grow business and customer automation.

Why SMS Falls Short in Modern Banking?

SMS has been a trusted channel for years. However, it no longer matches the needs of the modern banking industry. Customers want more than short, one-way alerts.

They want conversations, instant clarity, and a secure space to discuss private banking information.

SMS cannot support rich media, automated flows, or two-way conversations that help customers complete tasks quickly. It also limits how banks connect with customers because every message looks the same. There is no room for guided steps, interactive menus, or personalized service.

Security is another concern. SMS does not offer end-to-end encryption. This makes it harder for financial institutions to share sensitive details or build trust with customers who expect safer digital communication today.

Why Customer-Centric Banks are Adopting WhatsApp API?

There is a high chance that people will neglect the same kind of traditional SMS that banks send for alerts. This is where you need another approach for important messages and announcements.

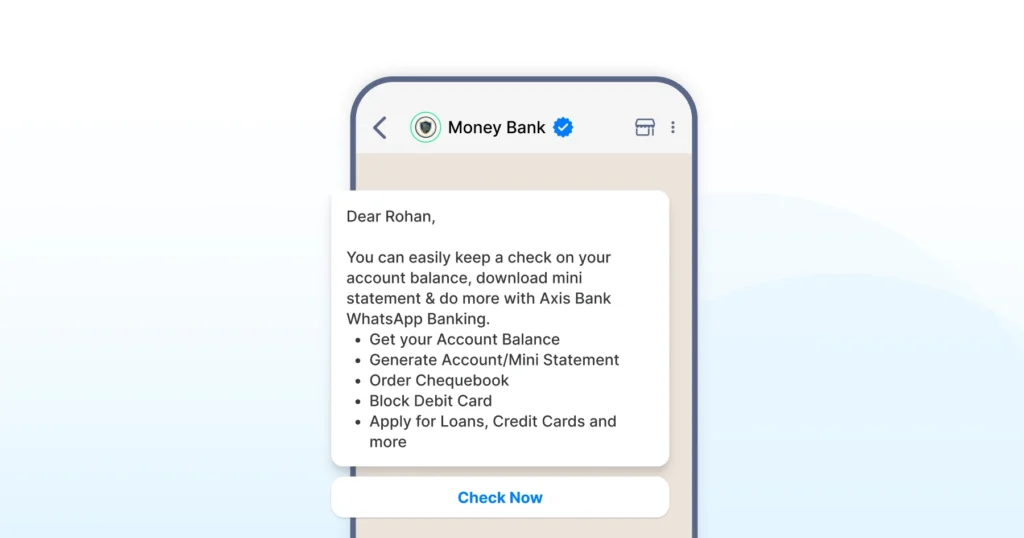

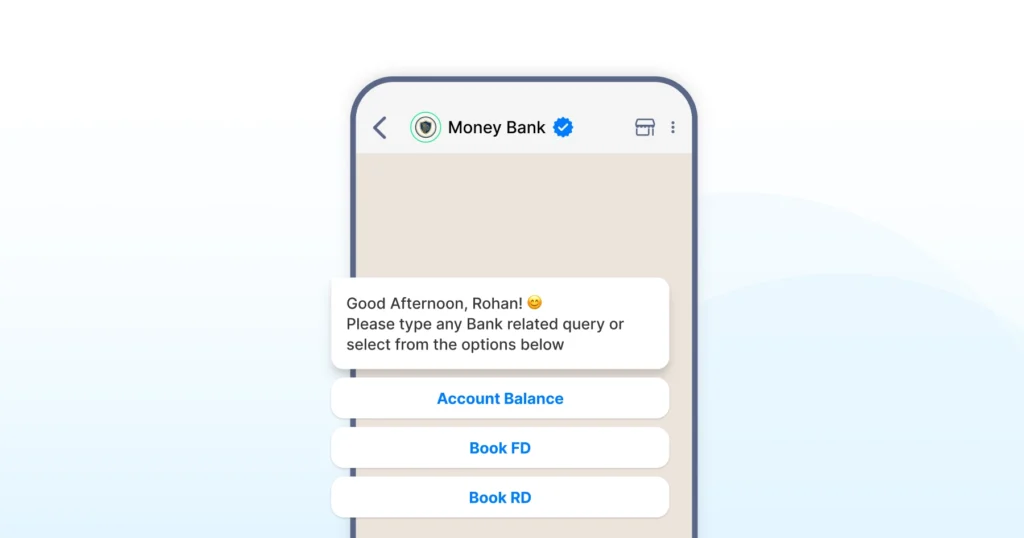

The WhatsApp Business API gives banks a communication channel built for the way customers interact today. It supports two-way conversations, secure messaging, and guided flows that help customers complete tasks without switching apps.

Banks can use WhatsApp to share account updates, send transaction confirmations, answer customer queries, or guide users through onboarding.

Features like automated messages, interactive buttons, and rich media make every interaction clearer and more helpful.

SMS vs. WhatsApp API: Top Features for Modern Banking

Here’s how the WhatsApp API for modern banks differs from SMS.

| Feature | SMS | WhatsApp Business API |

| Security | No end-to-end encryption | Encrypted messaging for private banking information |

| Conversation Style | One way notifications | Two-way conversations and guided flows |

| Rich Media | Text only | Images, PDFs, buttons, menus, rich media content |

| Automation | Very limited | Automated messages, WhatsApp automation, AI-powered user experience |

| Engagement | Low engagement | Higher engagement through conversational banking |

| Customer Queries | Hard to manage | Structured replies, quick responses, automated answers |

8 Top WhatsApp API Use Cases for Banks

Banks today need channels that do more than send alerts. They need a platform that helps customers take action, ask questions, and manage their accounts with ease.

The WhatsApp Business API opens that door by bringing everyday banking tasks into a familiar, conversational space.

Below are the use cases where WhatsApp truly adds value for the financial sector.

1. Account Balance Checking and Transaction History

Customers can check account balances or view recent transactions instantly through automated messages. This reduces wait times and improves customer satisfaction.

2. Transaction Alerts and Confirmations

Banks can send instant alerts for payments, withdrawals, deposits, or suspicious activity.

These real-time updates help customers stay aware of their account activity.

3. Customer Support and Query Handling

Automated responses and WhatsApp chat assistants help handle common customer inquiries.

Support teams can step in for complex questions, creating a smooth blend of automation and personalized service.

4. Onboarding and Lead Generation

Banks can guide potential customers through the onboarding process with automated flows. This helps simplify form submissions, savings account setup, and lead generation processes.

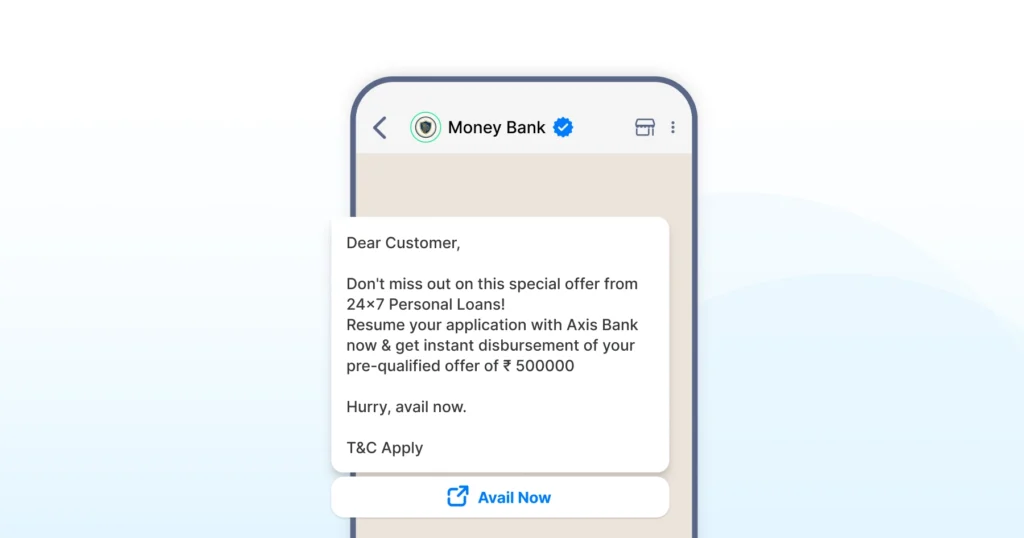

5. Credit Card and Loan Updates

Customers can track their credit card status, personal loan applications, or upcoming EMIs.

This keeps customers informed and reduces support costs.

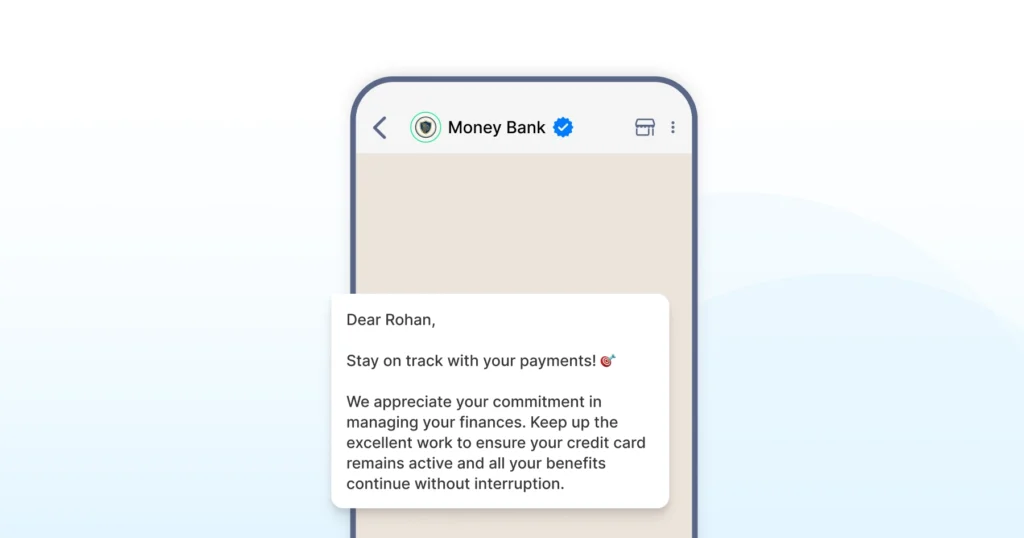

6. Payment Reminders and Bill Payments

Banks can send timely reminders for utility bills, EMIs, or credit card payments. Some financial institutions also allow direct bill payments through WhatsApp, increasing convenience.

7. Digital Payment Notifications

Real-time confirmations for UPI transfers, online payments, or wallet transactions make the customer experience more transparent and secure.

8. Personalised Financial Advice

With conversational banking and AI-powered user experiences, banks can offer personalised suggestions, financial tips, and product recommendations based on customer preferences.

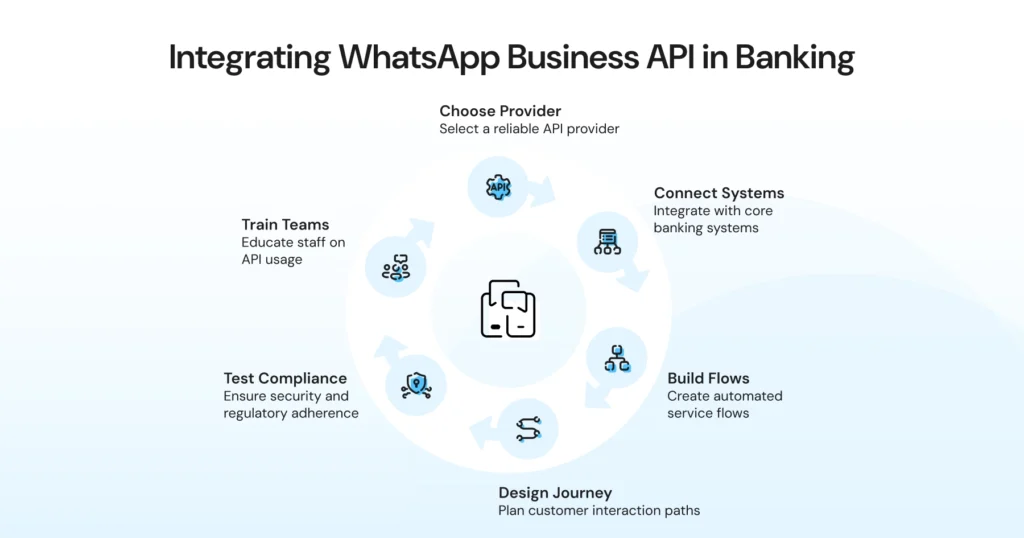

How Banks Can Integrate the WhatsApp Business API?

Integrating the WhatsApp Business API is simpler than most banks expect.

The process focuses on connecting existing banking systems with a secure messaging channel that supports automation, customer interactions, and real-time updates.

Read on to get a view of how financial institutions can get started.

1. Choose a WhatsApp API Solution Provider

Banks usually work with an official provider to set up their WhatsApp Business account.

This partner handles onboarding, compliance, and technical setup, making it easier to integrate WhatsApp without disrupting existing workflows.

2. Connect Core Banking Systems

The API can link with CRM tools, customer databases, mobile apps, and internal banking systems.

This allows you to send account updates, transaction alerts, and instant notifications automatically.

3. Build Automated Flows for Key Services

Banks can create automated responses and guided flows for account balance checks, transaction history requests, credit card status, or simple customer inquiries.

This improves operational efficiency and reduces support costs.

Also read: WhatsApp automation 101: Complete guide for 2026

4. Design the Customer Journey on WhatsApp

Most banks start small with essential services, then expand to onboarding processes, savings account assistance, personalised financial advice, or bill payments.

Each flow helps customers complete tasks faster in a channel they already use.

Also read: Customer journey analytics: How to monitor your lead performance via WhatsApp

5. Test for Security and Regulatory Compliance

The WhatsApp API supports end-to-end encryption, but banks still need to follow internal security protocols.

Reviewing compliance early ensures safe handling of private banking information across all customer interactions.

6. Train Teams and Inform Customers

Once live, banks should guide customers on how to use WhatsApp for account services.

This increases adoption and helps new customers enjoy a smoother, more conversational experience.

Why Many Banks Choose Wati as Their WhatsApp API Provider

When banks pick a WhatsApp API solution provider, they should evaluate features that map directly to banking priorities: secure messaging, reliable delivery, compliant workflows, automation, and team collaboration.

In this section, we’ve covered the key Wati features and why they matter for modern banks.

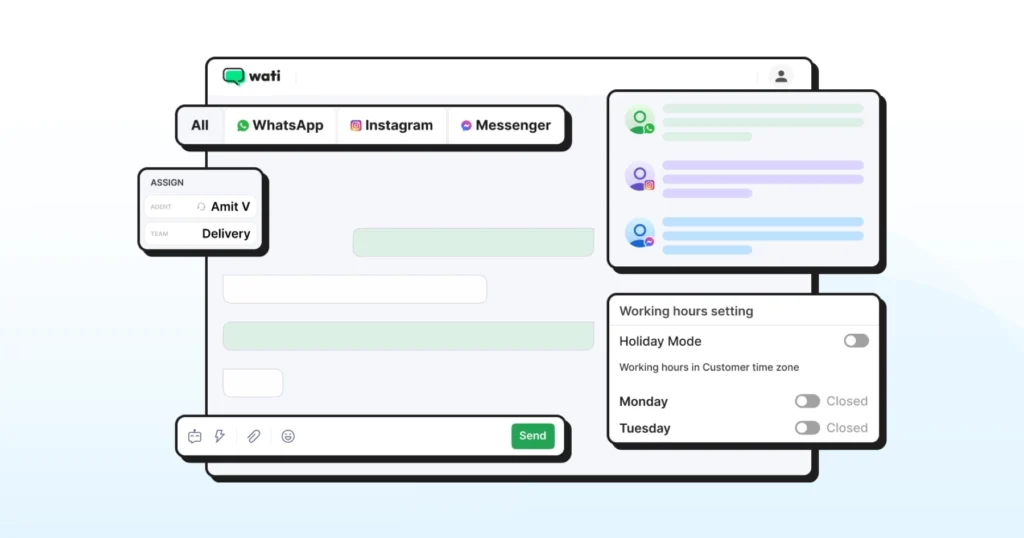

1. Shared Team Inbox & Multi-Agent Support

A unified inbox lets multiple agents access the same WhatsApp number, assign conversations, and pick up where others left off.

This improves response times for customer support, keeps onboarding flows smooth, and reduces the risk of missed customer inquiries.

2. No-Code Chatbot Builder

Wati’s workflow and chatbot tools let banks automate routine tasks like:

- Balance checks

- Transaction history lookups

- Payment reminders

- Guided onboarding

Automation reduces repetitive work, lowers support costs, and ensures consistent answers for common customer queries.

3. Rich Media & Template Support

The platform supports documents, PDFs, buttons, and lists.

Banks can securely send statements, KYC forms, or interactive menus for quick actions (e.g., “View statement” or “Report fraud”), which improves task completion rates and customer satisfaction.

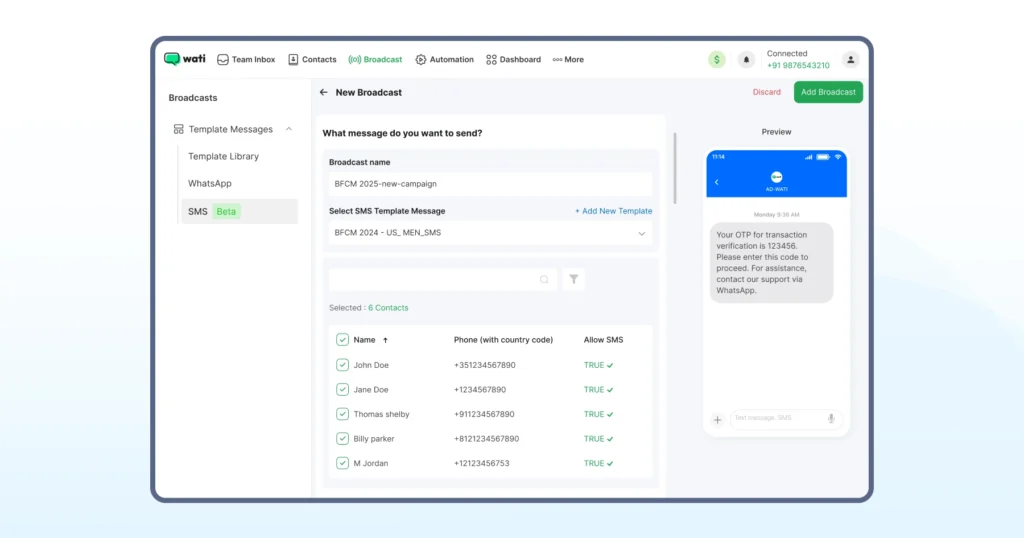

4. SMS Fallback

Wati supports SMS fallback for critical WhatsApp messages (OTP and campaigns). If a WhatsApp message fails (user offline, regional restrictions, or template rejection), the system can automatically send an SMS so the customer still receives the alert.

For banks, this reduces missed transaction confirmations, OTP failures, and delivery gaps that can frustrate customers.

WhatsApp API for Modern Banking: The Clear Winner

Banks are now prioritising a customer-oriented experience. They are shifting from static notifications to connected, conversational experiences.

Customers want guidance, clarity, and the ability to interact with their bank in the same effortless way they chat with friends.

WhatsApp Business API tools like Wati support this shift by giving financial institutions a channel to build around convenience, trust, and real-time engagement.

As banks rethink how they communicate, WhatsApp becomes less of a messaging tool and more of a customer experience layer.

Its automation tools, collaboration features, and delivery safeguards make it a strong partner for financial institutions looking to elevate their digital interactions.

Schedule a demo to give it a try today.

WhatsApp API for Modern Banking: Frequently Asked Questions

The WhatsApp API for modern banking is a secure, scalable tool that helps banks deliver real-time updates, support, and account services through WhatsApp. It enables two-way conversations, automation, and richer customer interactions compared to traditional SMS. Banks use it to create smoother and more convenient digital experiences.

Yes, the WhatsApp Business API uses end-to-end encryption to protect sensitive information. Banks can share account updates, confirmations, and support messages in a private environment. Combined with internal compliance controls, it meets the security needs of the financial sector.

For many use cases, yes. WhatsApp offers faster engagement and clearer messaging formats. However, banks can still use SMS as a fallback for urgent alerts or customers who are not active on WhatsApp. This combination ensures important updates always reach customers.

Banks can automate balance checks, transaction history, onboarding steps, loan updates, payment reminders, and common customer inquiries. Automation helps reduce support load while giving customers instant answers for everyday tasks.

It brings banking into a familiar, conversational channel customers already use. People can ask questions, get guidance, and complete tasks without switching apps. This reduces friction, increases clarity, and supports a more personalised customer journey.